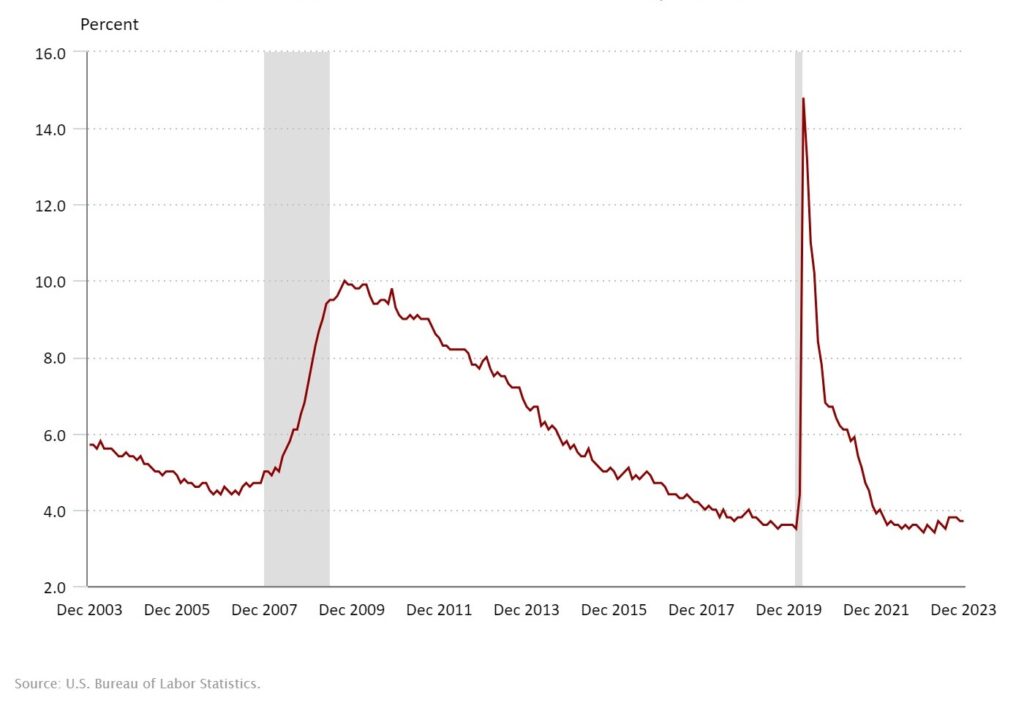

The post-pandemic U.S. job market continues to stabilize and grow — 2023 concluded with a steady rate of new hires and relatively low unemployment rates. While the Fed works to keep inflation in check and maintain steady economic growth, the overall labor market seems to be moving toward more normal conditions in many industries. For finance and accounting, however, the sector promises to be a hot labor market.

Looking at the 2024 Q1 employment report, the GDP’s 4.9% increase in the fourth quarter of 2023 was the biggest since 2021. Meanwhile, the unemployment rate held steady at 3.7% in December, according to the U.S. Bureau of Labor Statistics.

The University of Michigan’s Survey of Consumers showed a 14% leap in consumer sentiment in December, climbing to a midpoint between pre-pandemic levels and 2022 lows. After a year of recession worries, higher wages and lower-than-expected inflation contributed to a surge in confidence across all age groups and demographics.

In accounting and finance, an estimated 75% of CPAs reached retirement eligibility by 2020, and more than 300,000 accountants quit their jobs between 2019 and 2021. This creates opportunities for job seekers and requires creativity from employers.

Here is a look at what accounting and finance professionals and companies can expect in 2024.

With so many experienced accounting and finance professionals retiring, employers are finding creative approaches to attract talent, improve retention and develop the potential of existing employees to meet their finance and accounting needs.

Some employers stand out from the crowd, attracting and retaining skilled professionals by offering flexible work arrangements. Paired with competitive salaries, hybrid or remote work options are a significant draw.

Some hard-to-fill or high-demand positions are opportunities to upskill existing staff or hire for potential and trainability. In the wake of the 2023 bank failures, the financial services sector needs qualified risk and compliance professionals. Stock market fluctuations necessitate adept fund managers who can help clients rebalance their portfolios.

In alignment with trends toward skills-first hiring, managers are opting to relax experience requirements. Instead, they are recruiting entry-level professionals who demonstrate a strong capacity for learning on the job. This shift addresses immediate staffing needs and invests in the long-term development of a skilled workforce.

When you work with Century Group as your strategic staffing partner, we help you access a broad and diverse talent pool of accounting and finance professionals. This includes active job seekers and passive candidates open to the right opportunities. We tailor our recruitment strategies to fit your staffing needs.

The first quarter of 2024 presents opportunities for job seekers in the accounting and finance sectors. With the current talent shortage, there are several strategies and trends that prospective candidates should be aware of to maximize their chances in this competitive yet opportunity-rich market.

More firms are working with contract professionals, which opens an avenue for job seekers. Contract roles provide immediate employment opportunities that can lead to permanent positions. If you’re open to contract work, these positions can provide valuable experience, networking opportunities and a foot in the door at sought-after companies.

Roles in financial planning and analysis (FP&A), financial reporting, risk and compliance, fund management and general accounting are in high demand, with unemployment rates comfortably below the national average. Job seekers looking to enter the field or change roles should consider upskilling or reskilling in these high-demand areas.

To stand out to employers, highlight relevant skills and quantify your accomplishments on your resume and during interviews. Online and in-person networking can play a significant role in uncovering opportunities. For example, engaging with professional groups, attending industry events and staying updated with industry trends will help you make a mark in the finance and accounting sectors now and as your career develops.

In addition to accreditation and relevant skills, employers look for soft skills like leadership, collaboration, communication and the ability to present your ideas.

Working with a dedicated recruiting agency is a great way to accelerate your career. At Century Group, we only work with finance and accounting professionals, so we have deep expertise you can use to find a role and a company culture that genuinely matches your professional and personal needs.

Our 2024 Q1 employment report shows employers and job seekers in the finance and accounting sectors face unique challenges and opportunities. Both parties can navigate this dynamic landscape successfully by staying adaptable, focusing on skills development and leveraging specialized resources like Century Group. The year ahead promises growth and advancement for those prepared to seize the opportunities in this evolving market.