The first half of 2024 has been well, slower, for the U.S. economy, to say the least. Real GDP growth decelerated to 1.4% in Q1 this year from 3.4% in Q4 2024 — a result of inflation and elevated interest rates that have impacted consumer spending and domestic demand the first six months of the year, according to The Conference Board.

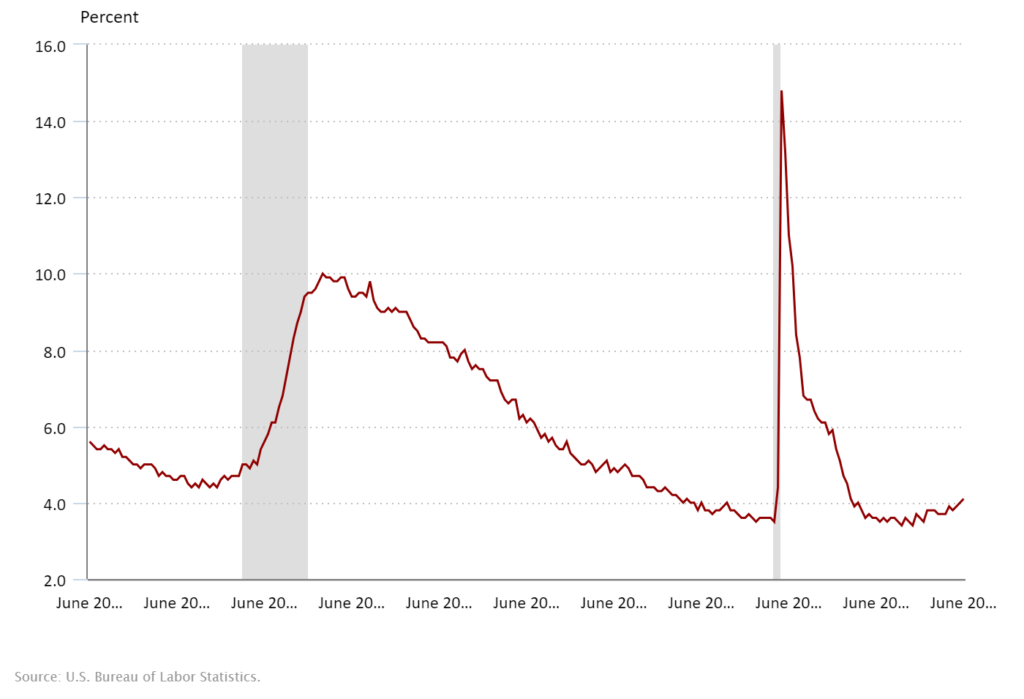

In June, employers’ payrolls increased by 206,000 jobs, and is a continuation of the 12-month trend of the U.S. adding an average 200,000 jobs each month. The national unemployment rate changed little at 4.1%, per the U.S. Bureau of Labor Statistics.

What can we expect for the latter half of 2024? More of the same, but there is hope for economic growth to pick-up toward the end of the year as inflation continues its cool down from 2022’s peak of 9.1%.

“In all, the very cool inflation data provided clear evidence that inflation is slowing meaningfully, exactly the kind of progress that Fed officials have been hoping to see as they contemplate when to begin cutting interest rates,” explains the New York Times.

In fact, Grant Thorton’s new survey of more than 225 senior financial leaders showed that 56% of participants are feeling confident about growth projections. Even more, 58% of respondents said that attracting and retaining key talent is a priority for the next 12 months. And, with the demand for skilled accounting and finance professionals in a shrinking sector — Q3 and Q4 have a lot of optimism in store.

Here’s our forecast of what both employers and job seekers can expect in Q3 2024.

In an uncertain market, it’s understandable for companies to be more cautious in their hiring decisions. But that tactic may be costing you top talent.

Slower interview processes and limiting hiring strategies to only permanent roles can be inhibiting businesses from landing candidates with the most in-demand skills, experience and credentials. Effective steps like streamlining recruitment approaches from five interviews to two, or taking on consultants while identifying that direct hire unicorn can help you get the right people in the seat without affecting productivity.

Another key factor to consider: what matters most to today’s worker. According to new research by Economist Impact, many employers are missing opportunities to align their benefits to employees’ expectations.

“Just three in 10 employees at mid- and large-sized American companies strongly agree that they are satisfied with their retirement plan,” the research showed. “Nearly six in 10 (57 percent) are not confident they will be able to retire at the federal retirement age.”

Evaluate your company’s compensation, benefits and other perks to see how they measure up. Not sure where to start? Check out some of these effective strategies that can help with both talent recruitment and retention.

The job market has been largely candidate-driven for the past few years, with the highest number of U.S. workers quitting their jobs in a single month peaking in April 2022. This clear power dynamic resulted in companies boosting salaries, offering flexible schedules and other attractive tactics to win over skilled talent.

Job seekers’ confidence has waned, however, and the quitting rate now sits below pre-pandemic levels at 2.2%. This trend comes alongside white-collar slowdown and decline in compensation for new hires, according to The Wall Street Journal.

Still, accounting and finance professionals do have an advantage — touting a much lower unemployment rate than the national average. Candidates seeking new opportunities in these functions can stand out from their peers by upskilling in areas that are most sought-after by employers, including, artificial intelligence, problem solving and earning advanced credentials.

Browse our most recent jobs in your area or connect with one of our seasoned recruiters today.