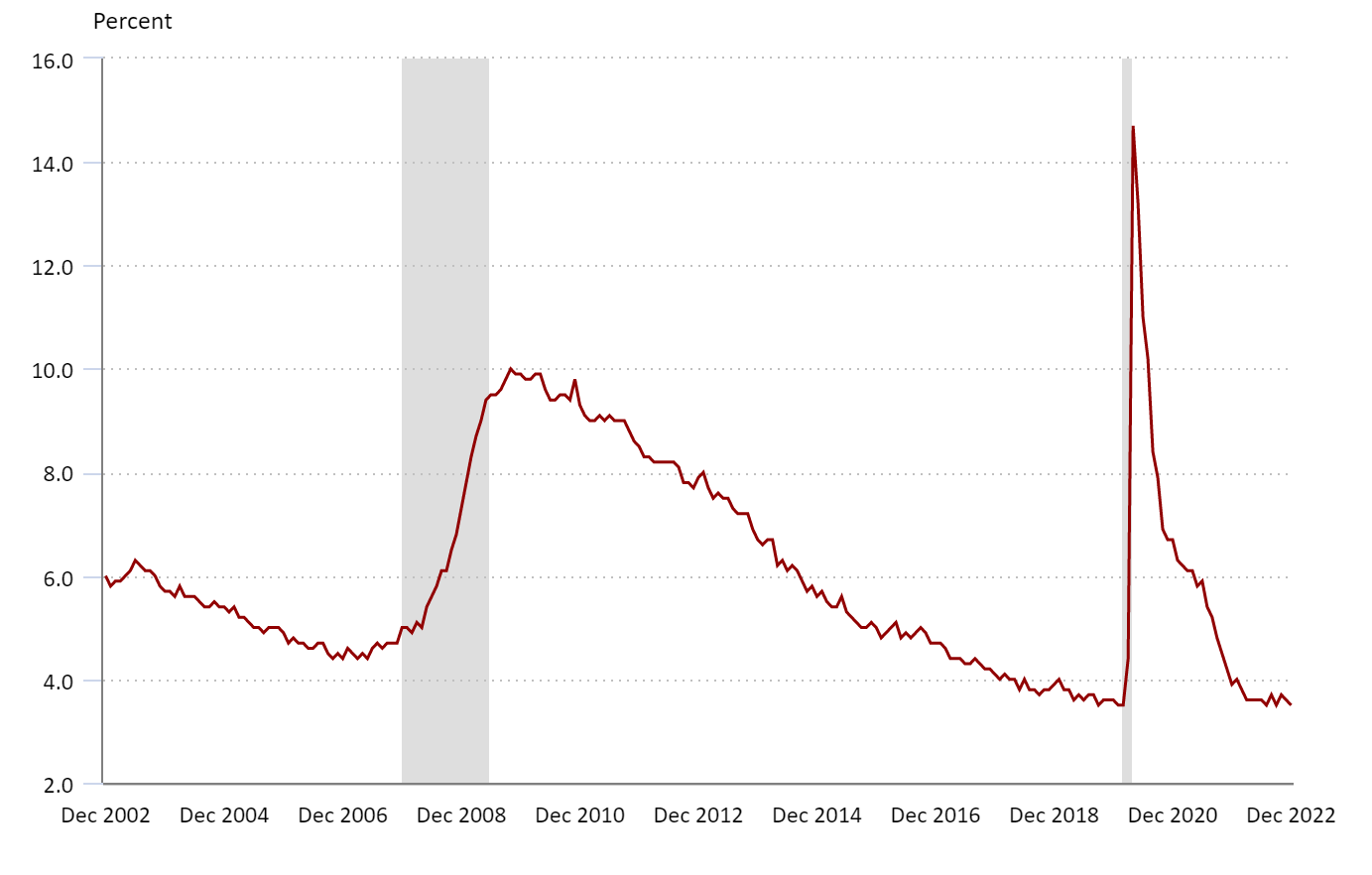

In 2022, the U.S. added 4.5 million jobs — the second-most on record, according to the New York Times. And while job production maintained its slowing trend, employers increased their payrolls by 223,000 jobs in December, which included gains in construction, retail trade, manufacturing, financial activities and transportation industries. The national unemployment rate edged back down to 3.5% from November’s 3.7%.

Credit: U.S. Bureau of Labor Statistics

So, what does this mean for the quarter ahead?

ITR Economics‘ 2023 outlook remains cautiously optimistic and continues to expect GDP growth throughout the year. In fact, the likelihood of a mild recession on the horizon is tempered by what they foresee as a relatively tight labor market compared to prior recessions.

“There are roughly two job openings for every unemployed person in the U.S.,” ITR explains. “We are not likely to see that ratio reverse to a negative number during the next two years, which will keep upside pressure on wages and indicates consumers will have the ability to continue spending, even if the pace is not as robust as in the prior years.”

We detail more of what employers and job seekers can expect in Q1 for 2023:

Demand for temporary workers in the U.S. is expected to increase by 1.1% this quarter, even as the need for consultants has been softening for the last few months, according to Palmer & Associates’ Palmer Forecast. Employers rely on temporary workers to complete key projects and assist with brimming workloads without having to commit to a long-term arrangement — and is clearly a hiring tactic that’s expected to continue in 2023.

Even more, the New York Times highlights that the low unemployment rate translates to another year of talent having the upper hand in the labor market, with half of the global C-Suite leaders surveyed in the Palmer Forecast expecting wages to remain on the rise.

Along with competitive offers and at-market compensation, hiring for key skills instead of credentials is a trend hiring managers are expected to lean into. Identifying specific soft talents can start as early as the interview process or as late as your most tenured employee. In fact, upskilling is a cost-effective way for companies to invest in their current staff to provide professional development opportunities while meeting their business goals.

Request top financial talent for your temporary or direct hire needs today.

Sure, while the tight job market illustrates two job openings for every available candidate, inflation and other economic concerns are leaving some employers cautious when it comes to growing their teams.

Stand out from your peers by prepping for the future interviews using our research guide — making sure you know how to adeptly quantify your value through past performance situations. Employers are also putting more emphasis on your digital footprint this year. Take inventory of your online presence and adjust accordingly.

Get a start on your job search by checking out our newest accounting and finance opportunities near you.