If you’re pursuing a career in Human Resources, you already know the importance of communication, empathy, and strategic thinking. But when it’s your turn in the hot seat, how do you stand out? Whether applying for a generalist role or a specialized HR position, there are a few key questions you can count on.

Here are three essential interview questions every HR candidate should be ready to ace — and how to do it.

1. “How do you handle confidential information?“

HR professionals are trusted with sensitive data — from employee records to performance issues. Employers want to know you understand the importance of discretion and compliance.

How to ace it:

Share a specific example that demonstrates your integrity and understanding of confidentiality protocols. Mention any tools or systems you’ve used to manage sensitive information securely.

Example:

“In my previous role, I managed employee files and performance documentation. I ensured all records were stored in a secure HRIS and followed strict access protocols. When handling sensitive conversations, I always maintained professionalism and documented appropriately.”

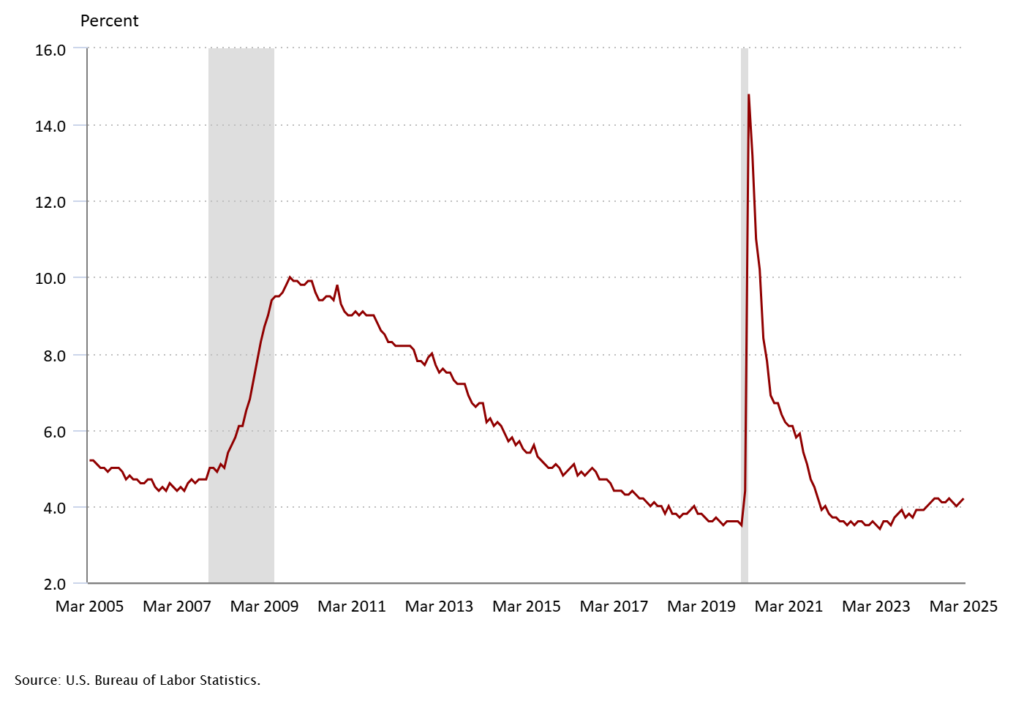

2. “How do you stay current with employment laws and HR trends?”

HR is a fast-evolving field. Employers want candidates who are proactive about staying informed and compliant.

How to ace it:

Talk about the resources you use — newsletters, certifications, webinars, or professional organizations. Bonus points if you can mention how you’ve applied new knowledge to improve a process or policy.

Example:

“I subscribe to SHRM and attend quarterly webinars on labor law updates. Recently, I helped revise our remote work policy to align with new state tax regulations for distributed teams.”

3. “Describe a time you resolved a workplace conflict.”

Conflict resolution is a core HR function. This question tests your interpersonal skills, neutrality, and ability to mediate effectively.

How to ace it:

Use the STAR method (Situation, Task, Action, Result) to walk through a real example. Emphasize your listening skills, fairness, and focus on positive outcomes.

Example:

“A manager and team member had ongoing tension over workload expectations. I facilitated a one-on-one with each, then a joint meeting to clarify roles and set mutual goals. Within a month, their collaboration improved, and team productivity increased.”

Are you looking for a new career opportunity in the HR field? Our recruiters can help you feel prepared and confident throughout the entire process. Submit your resume today!