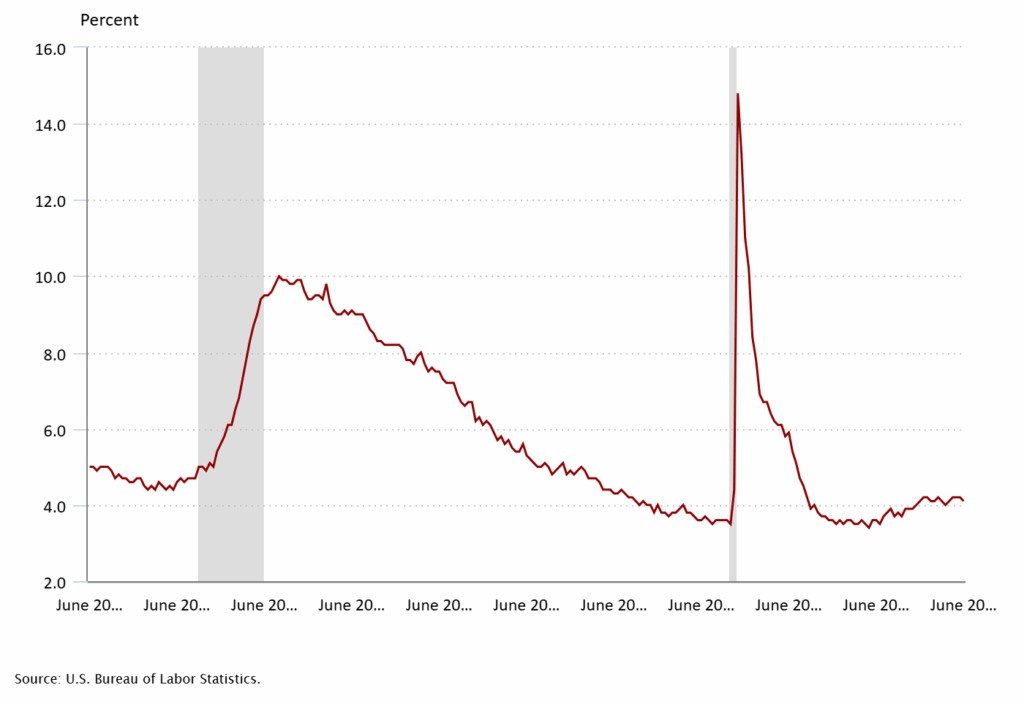

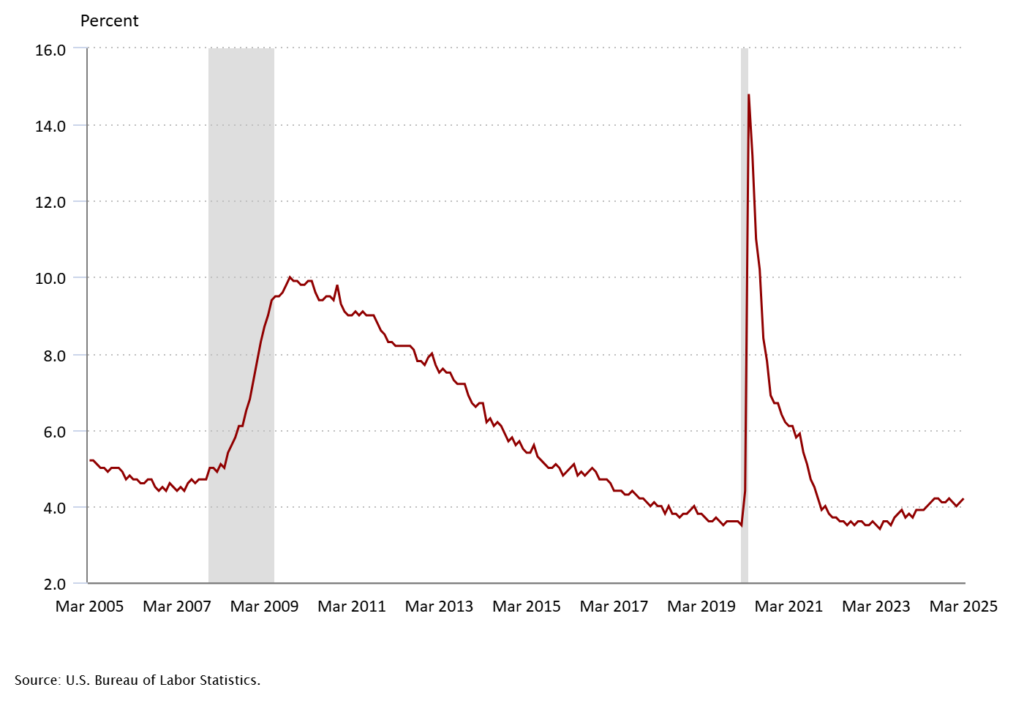

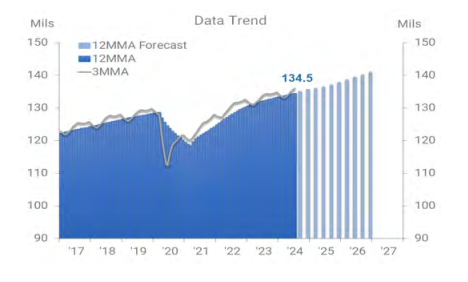

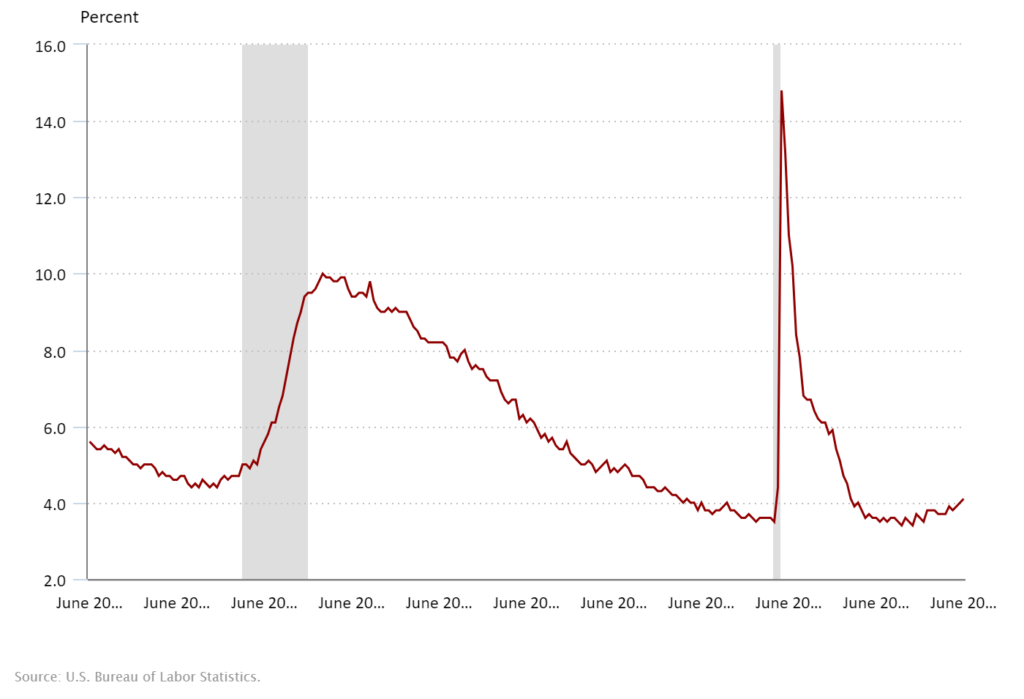

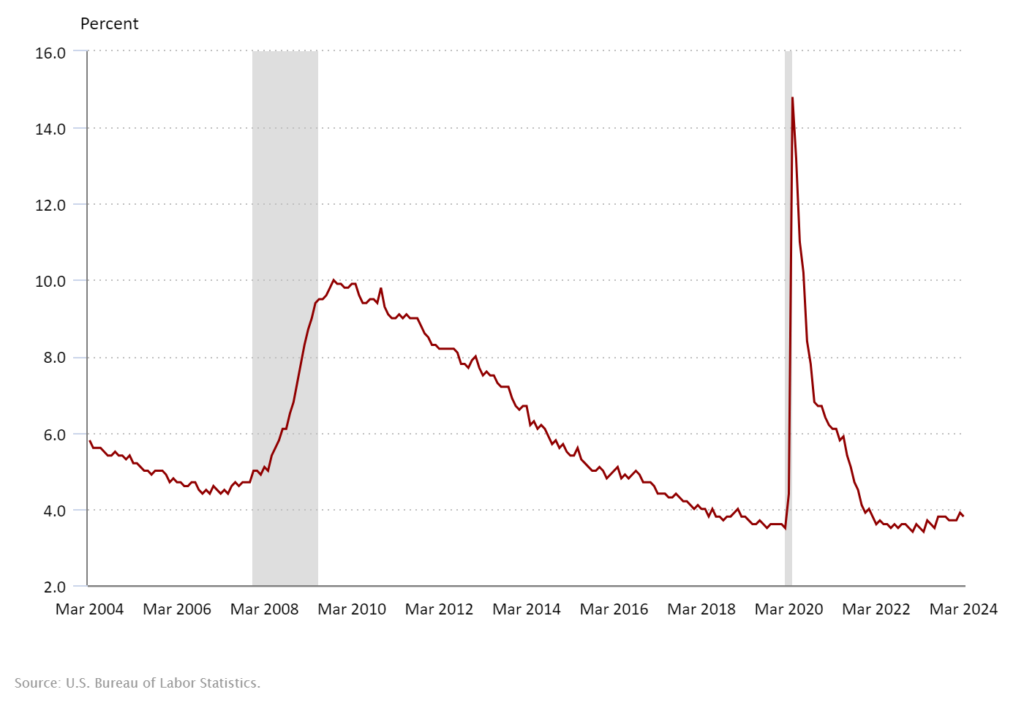

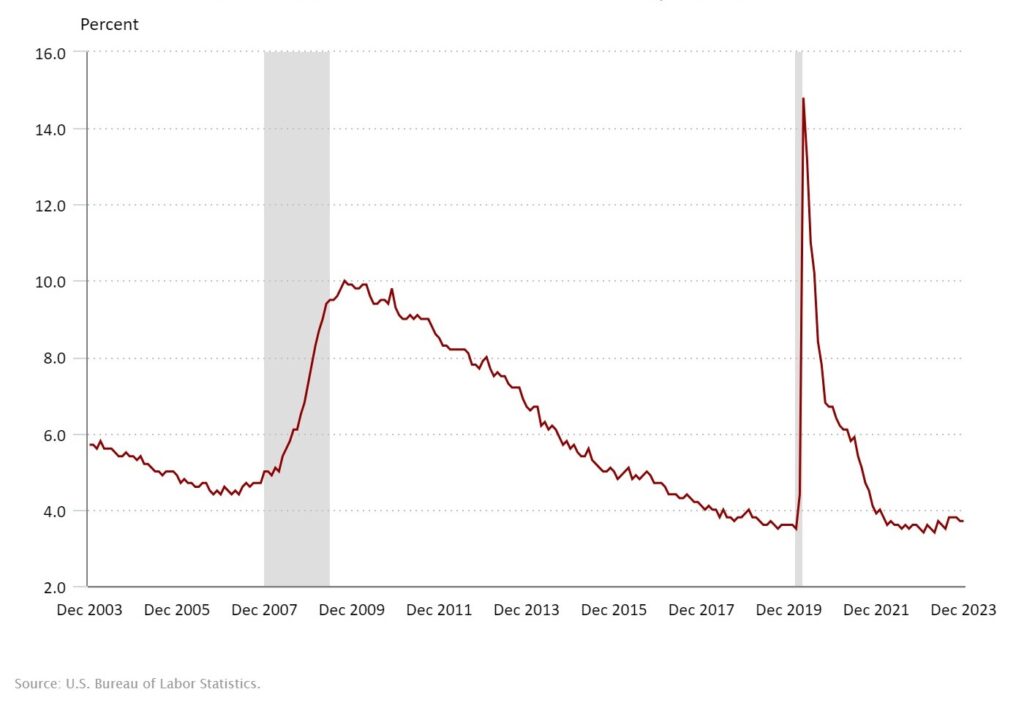

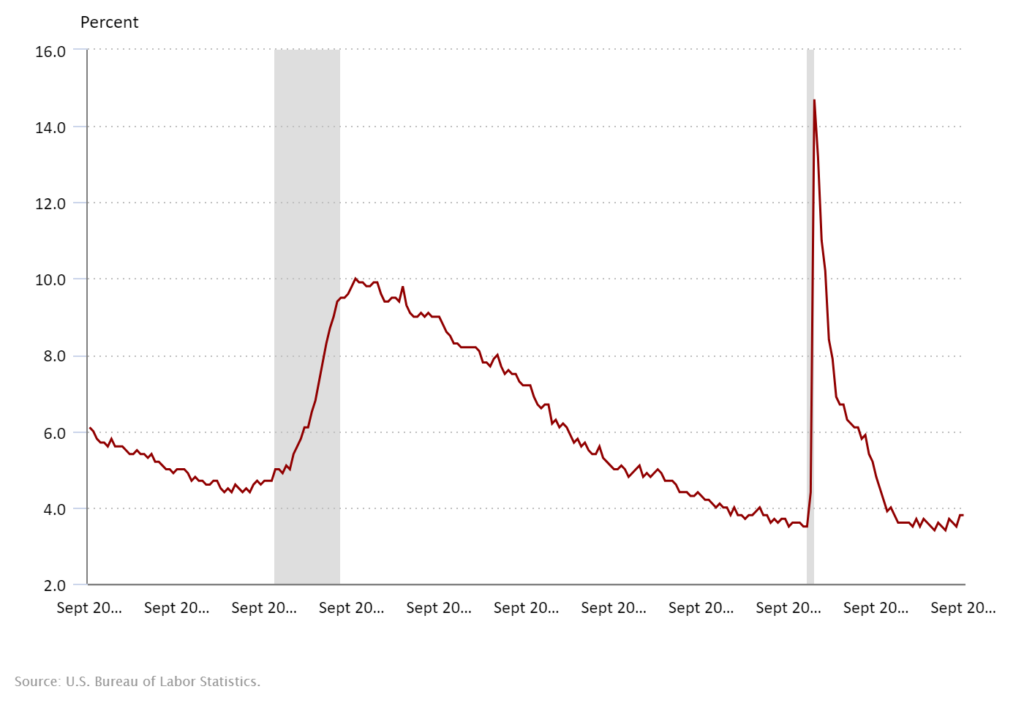

The U.S. labor market added only 17,000 jobs in September, according to Wall Street Journal — dropping from an already unimpressive 22,000 in August. The unemployment rate notched up to 4.3% in August, as well, marking a near four-year high. However, the data reveals a market in transition rather than crisis.

August’s modest job growth fell sharply below the typical monthly gains of 150,000 or more seen in healthier economic periods. “The labor market has hit stall speed” said Nicole Cervi, an economist at Wells Fargo.

Yet signs of underlying stability persist. In August, healthcare added 31,000 jobs, and wage growth continued at a solid 3.7% annually. The overall trend shows companies adopting a “wait and see” approach to expansion rather than wholesale contraction. Federal government employment has declined by 97,000 positions since January, and manufacturing jobs have dropped by 78,000 over the year.

This uneven impact across sectors reflects broader economic shifts, with service industries experiencing pressure while essential services maintain stability. Companies still need accounting, finance and HR expertise for regulatory compliance, despite overall staffing reductions in professional services.

For Employers

The hiring slowdown reflects companies taking a more selective approach rather than broad expansion. Professional services lost 17,000 positions in August, while the average workweek held steady at 34.2 hours — indicating businesses are managing through strategic hiring rather than cutting hours.

This creates two clear opportunities: First, focus recruitment on roles required for year-end compliance and regulatory deadlines, positions that cannot be deferred regardless of market conditions. Second: tap the expanded talent pool for contract and interim roles. Companies reducing headcount create opportunities to access talent that might not have been available in a tighter market.

Contract arrangements provide dual benefits. Organizations gain access to specialized expertise for specific initiatives, and they can evaluate potential permanent hires through actual work performance.

For Job Seekers

This hiring environment creates both challenges and clear pathways forward. With long-term unemployment up 385,000 over the year and the average duration of joblessness at 24.5 weeks, the longest since April 2022, job searches are taking longer. However, healthcare hiring and ongoing wage growth indicate selective rather than wholesale contraction.

Contract-to-hire positions have become a primary entry strategy. Employers are testing relationships before permanent commitments, making these roles a gateway to full-time opportunities. Many companies prefer evaluating candidates through actual work performance rather than traditional interview processes.

Professionals who can move to take advantage of available opportunities have more options. While national job growth has stalled, regional variations persist. Markets with strong healthcare systems, growing technology sectors, or robust local economies continue adding positions.

Job seekers can improve their digital proficiency. Employers seek candidates who can automate processes and implement new financial technologies. Skills in data analysis and process improvement distinguish candidates in competitive markets.

Professional certifications carry increased weight when hiring managers evaluate similar candidates. Current CPA licenses, specialized certifications in areas like forensic accounting or financial analysis, and technology-specific credentials demonstrate commitment to staying current with industry demands.

For more guidance on navigating today’s employment landscape, contact our team to discuss how we can level up your hiring or job search needs this quarter.