The outlook for the U.S. labor market in 2024 signals a shift back to stability and regularity. Bolstered by the robust consumer spending and labor market of 2023, the recession concerns have diminished.

Economists anticipate a more stable economic climate, especially with inflation on a downward trajectory. While unemployment could see a marginal rise and job growth may temper, the demand for finance and accounting professionals is expected to remain exceptionally high.

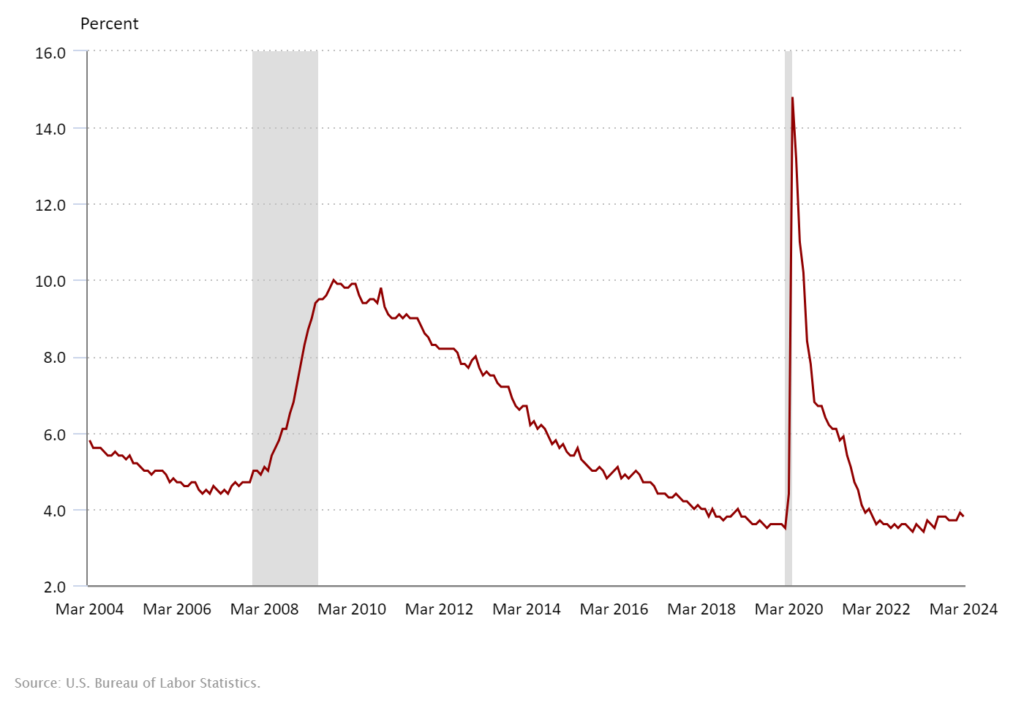

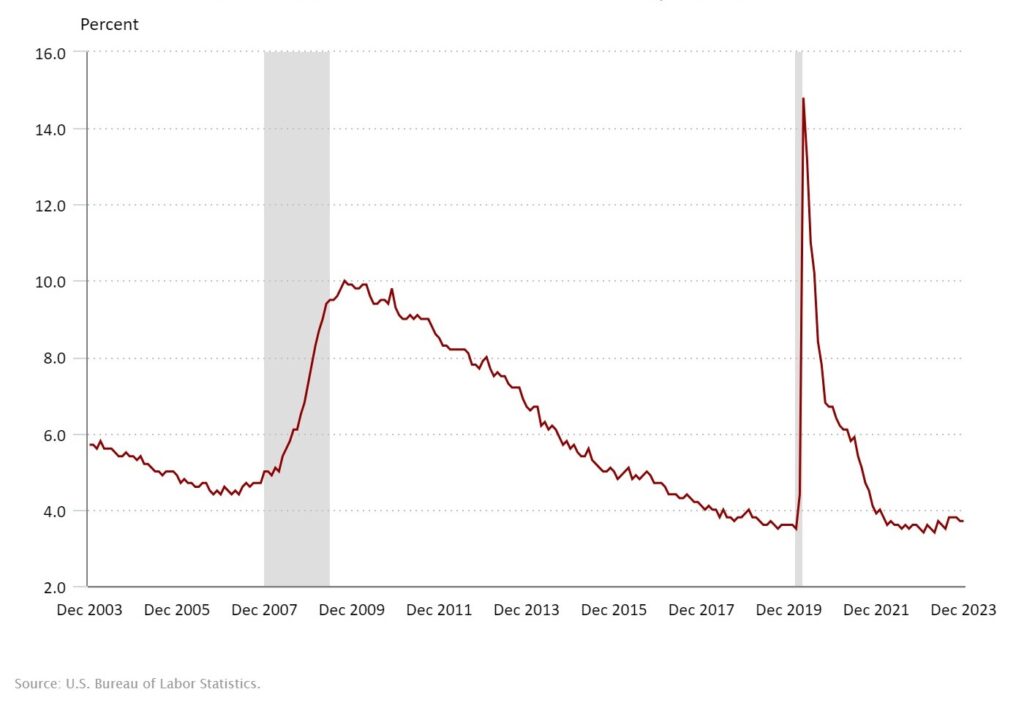

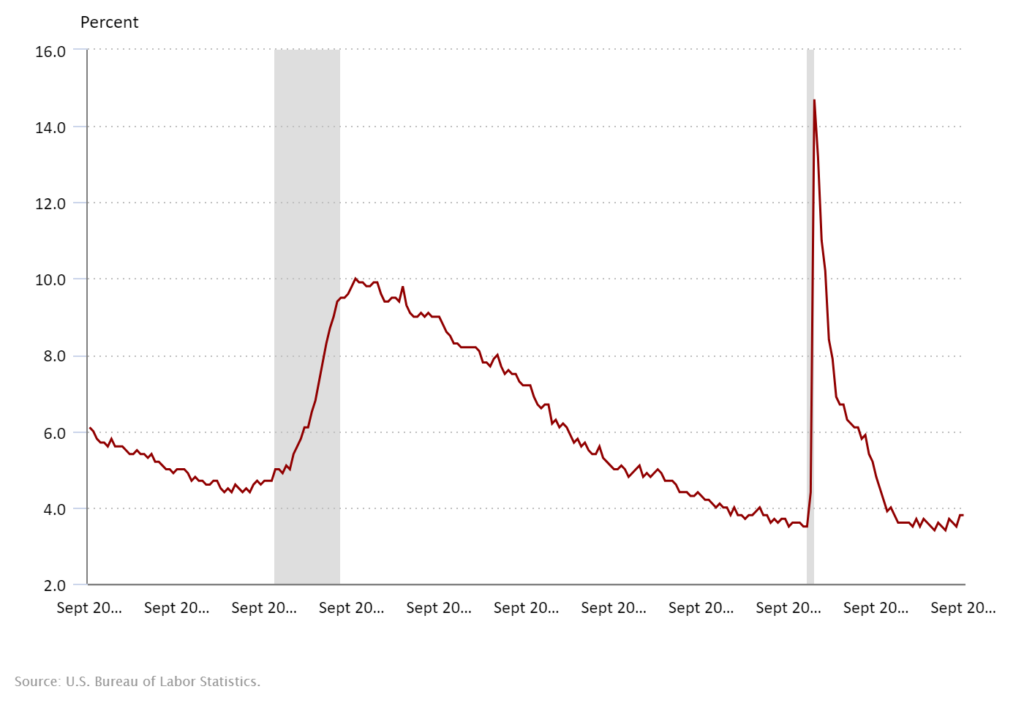

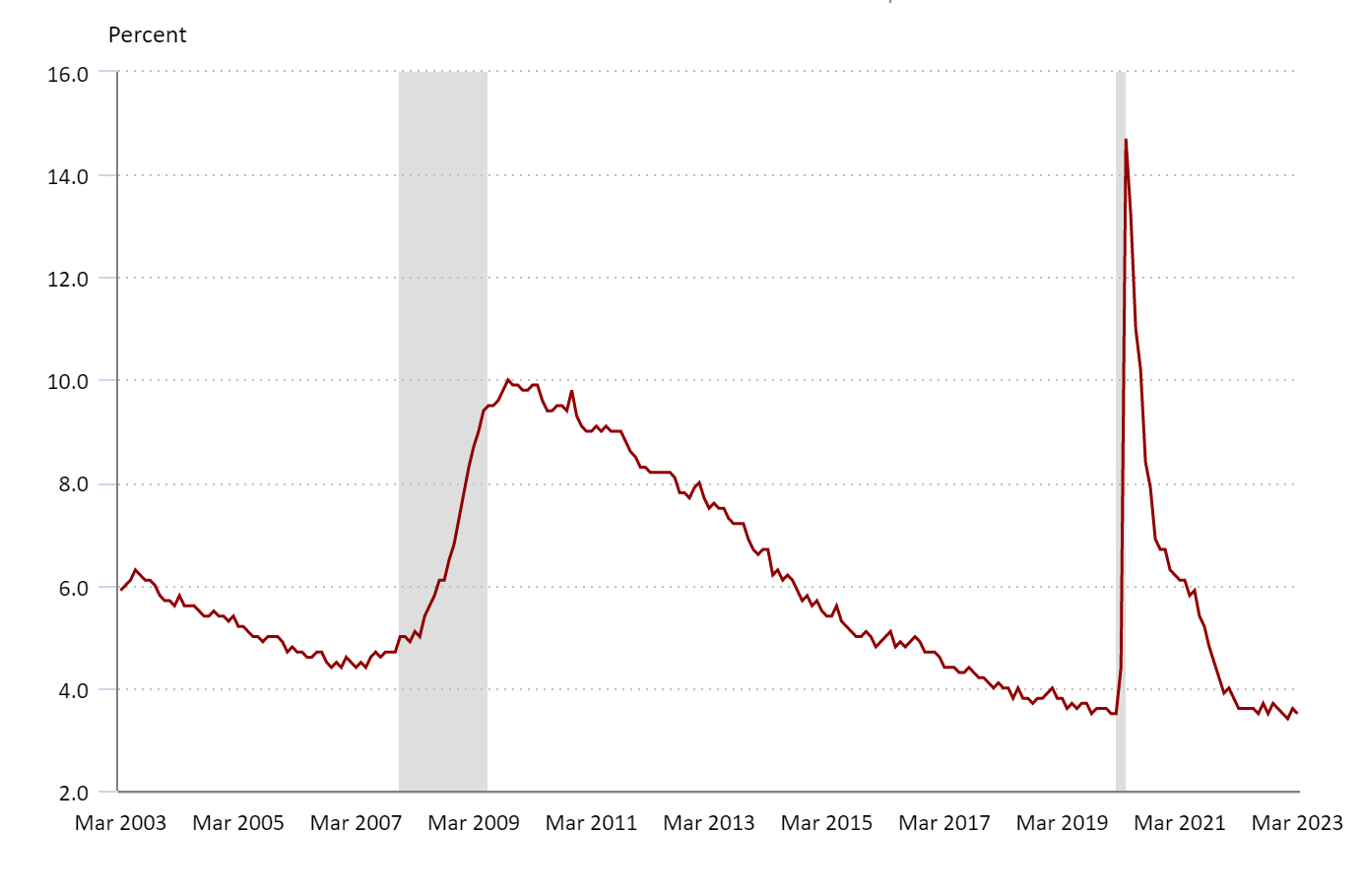

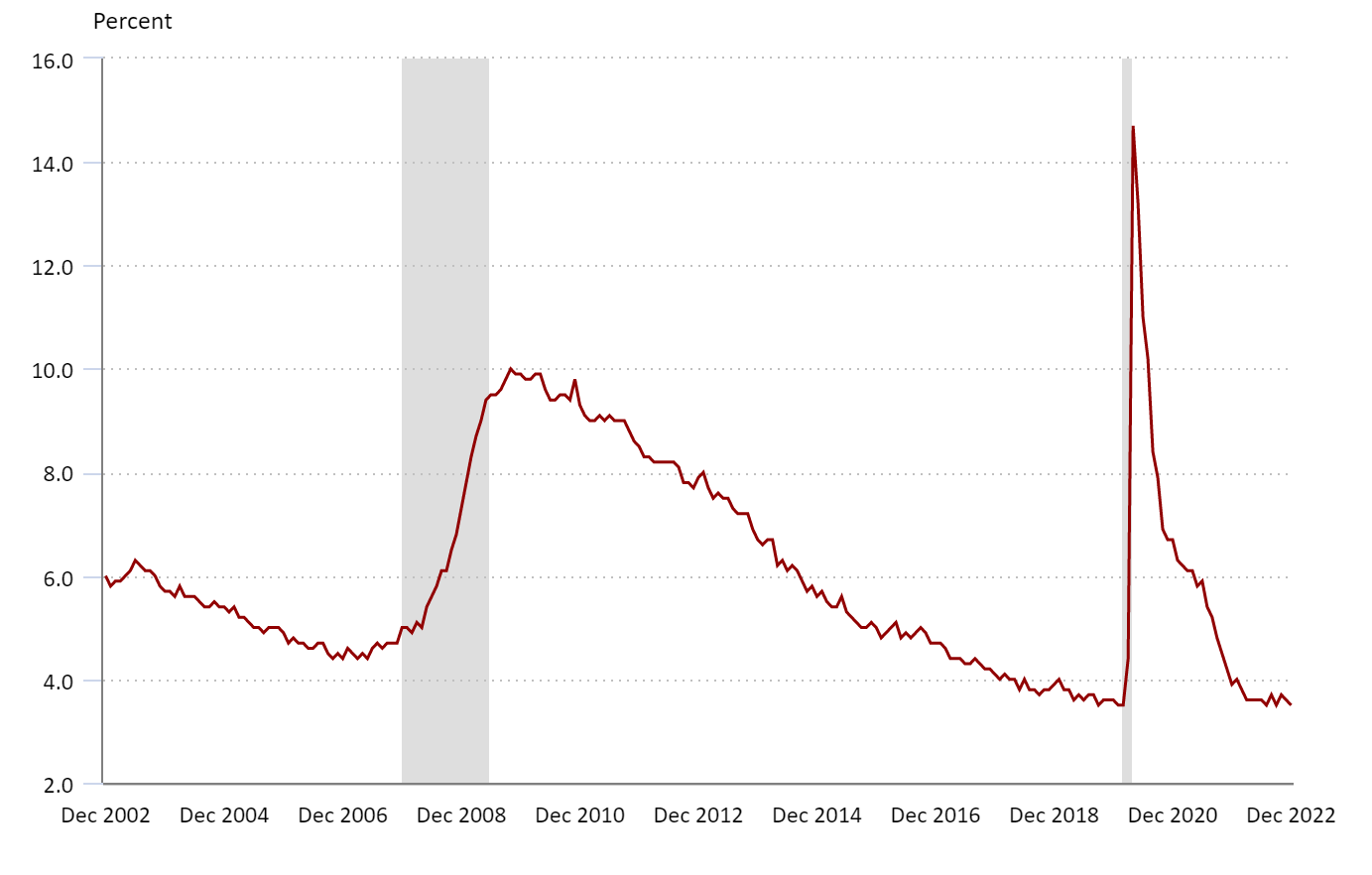

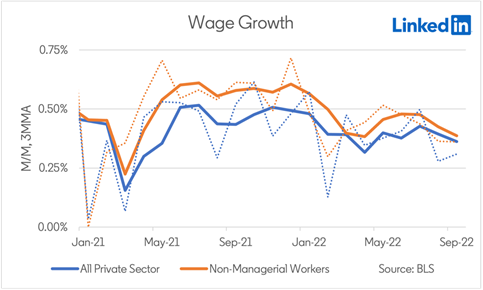

The projected annual GDP growth of 2.6%, supported by a decline in inflation, sets a promising economic backdrop. According to the March Employment Situation Summary from the Bureau of Labor and Statistics (BLS), average hourly earnings have increased by 4.1% over the past year, with a notable 0.2% rise in March. Meanwhile, the unemployment rate has consistently hovered between 3.7% and 3.9% since August 2023, staying level at 3.8% in March.

Given this backdrop, here’s what employers and accounting professionals can expect in the upcoming quarter of 2024.

FOR EMPLOYERS

The current hiring landscape in finance and accounting is complex. The shortage of accounting professionals became visible on Wall Street recently when Lyft Inc., Planet Fitness Inc., Mister Car Wash Inc. and Rivian Automotive Inc. had to correct typos in their quarterly earnings statements. Mistakes happen, but the increasing demands on accounting staff are cited as a significant cause of the recent increase in errors.

Talent Shortage Increases Burnout Risk

This staffing shortage, driven by the retirement of seasoned practitioners and the industry’s challenges in attracting the next generation, has increased workloads and extended hours for existing staff. The heightened risk of errors and burnout is a practical reality.

Efficiency and Automation

The pathway to efficiency includes leveraging automation tools and assigning more tasks to noncertified professionals where appropriate — freeing accountants to focus on the highest value work.

The thoughtful use of technology and noncertified professionals to improve workflow efficiency can limit the manual and repetitive tasks that hamper productivity. It can also increase accuracy and alleviate other issues caused by the staffing shortage.

Emphasize Social Impact

In addition to competitive salaries and job stability, Gen Z accountants seeking entry-level positions respond to social impact keywords. Employers who connected the accounting position to sustainability efforts, supporting local communities or other social impact keywords received 80% more applications.

When you work with Century Group as your strategic staffing partner, you gain access to our extensive network of accounting and finance professionals, including many passive candidates who would never respond to a job posting but are open to the right opportunity. Our diligent efforts and deep industry relationships have cultivated a network of candidates who can help drive your business forward.

FOR JOB SEEKERS

Navigating the job market in accounting and finance requires a clear understanding of where you are in your career and the strategies and leadership skills needed for advancement. At the heart of this journey is recognizing your expertise is a substantial asset that can open doors, especially with the right specialization and certification.

Career Growth and Opportunities

Accounting offers many options, from public and corporate accounting to roles within government sectors. Each path provides unique opportunities to specialize and progress toward high-level finance roles.

The demand for skilled finance and accounting professionals is high, and salaries are rising, which can translate into stiff competition for the most desirable roles. Focusing on niche areas within accounting can set you apart. Professional certifications can enhance your credibility and position you for advancement.

Market Dynamics

As some accounting tasks are automated, staying adaptable and upskilling are critical.

More employers want candidates with data analysis and interpretation skills alongside core accounting knowledge.

This shift reflects vast amounts of available data, emerging technology, and the value of analytical capabilities in decision-making processes.

Adapting to Change

Continuing to upskill ensures you remain indispensable as the field and technology evolve. Depending on where you are in your career now, you may want to develop leadership skills and an understanding of business processes. Analyzing financial data to forecast trends and impact profitability positions you to help steer the organization’s financial strategy.

At Century Group, we specialize in advancing the careers of accounting and finance professionals. Whether you’re seeking to accelerate your career trajectory or find a position with opportunities for professional development or advancement, our expert team is here to help you find the right role.

Strategically Positioning for Future Opportunities

The 2024 Q2 Accounting and Finance Employment Report paints a picture of a labor market rebounding and stabilizing in the wake of the pandemic. The finance and accounting sectors hold a strong and vital position as the U.S. labor market transitions toward a more normalized state. By staying attuned to market dynamics and embracing strategic workforce development, employers and professionals can navigate this landscape and capitalize on the opportunities it presents.

-Source: U.S. Bureau of Labor Statistics

-Source: U.S. Bureau of Labor Statistics